Unlocking the Potential of Using a Reverse Mortgage Calculator

Unlocking the Potential of Understanding Reverse Mortgage Calculators

A reverse mortgage calculator is a powerful tool for retirees looking to utilize their home equity into cash.

Aimed at older homeowners, reverse mortgages offer a way to leverage home equity without the necessity of moving.

Benefits of Using a Reverse Mortgage Calculator

Utilize this calculator to receive estimates of how much you can receive from a reverse mortgage.

Among the essential benefits is having an accurate calculation of your potential loan amount . It considers your age , the home’s value, expected interest fluctuations, and variables.

You can explore various payout scenarios to meet different financial demands and lifestyle goals.

The Functionality Behind Reverse Mortgage Calculators

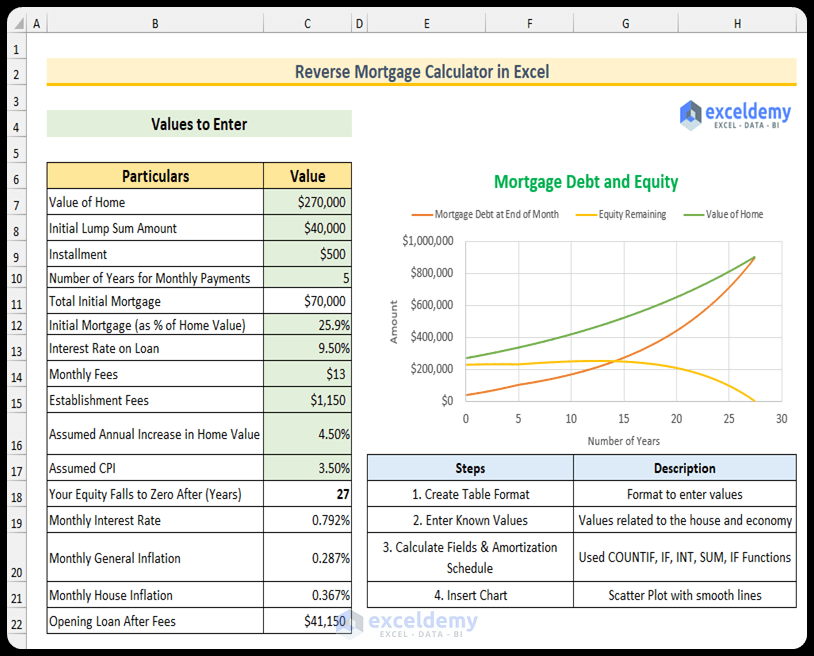

Understanding the workings of a reverse mortgage calculator begins with inputting your age and the expected value of your home.

You will then input the outstanding balances or other liens on the property, if any, as these will impact the calculations.

After inputting these variables , the reverse mortgage calculator provides a comprehensive estimate regarding the proceeds you could expect.

Variables Impacting Calculations

- Age: The age of the borrower plays a significant role in calculating loan amounts since eligibility often increases with age.

- Home Value: The more your home is worth, the more you'll potentially borrow.

- Interest Rates: Interest rates significantly impact the loan amount. Lower rates often result in more cash availability.

Understanding these factors allows you to make better financial decisions .

Scenarios Where a Reverse Mortgage Calculator Is Beneficial

Consider a scenario where increasing healthcare costs become financially stressing for a retiree on a fixed income.

Utilizing a reverse mortgage calculator provides visibility of potential financial relief , allowing for informed decisions to address these financial liabilities.

Making Informed Decisions with Reverse Mortgage Calculators

Navigating the nuances of reverse mortgages is challenging, but using a reverse mortgage calculator streamlines the process .

By utilizing a calculator, it guarantees that every decision is backed by reliable estimates and verified financial metrics.

No matter your intention, a reverse mortgage calculator serves as a foundation for sound financial decisioning with reverse mortgage prospects.

Knowing the Calculator’s Boundaries

Though a reverse mortgage calculator is informative, understanding there are boundaries is equally significant.

For complete accuracy , one must rely on experts beyond the calculator’s scope.

Summing Up

A reverse mortgage calculator serves as an indispensable resource in evaluating the use of home equity through a reverse mortgage.

Providing a clear overview of potential borrowing amounts and scenarios, it facilitates making informed decisions in aligning financial strategy.